What Is the Best Fidelity Core Position

FCASH is interest-bearing with an interest rate of 001 percent as of 2012. Are either recommended over an FCASH core position.

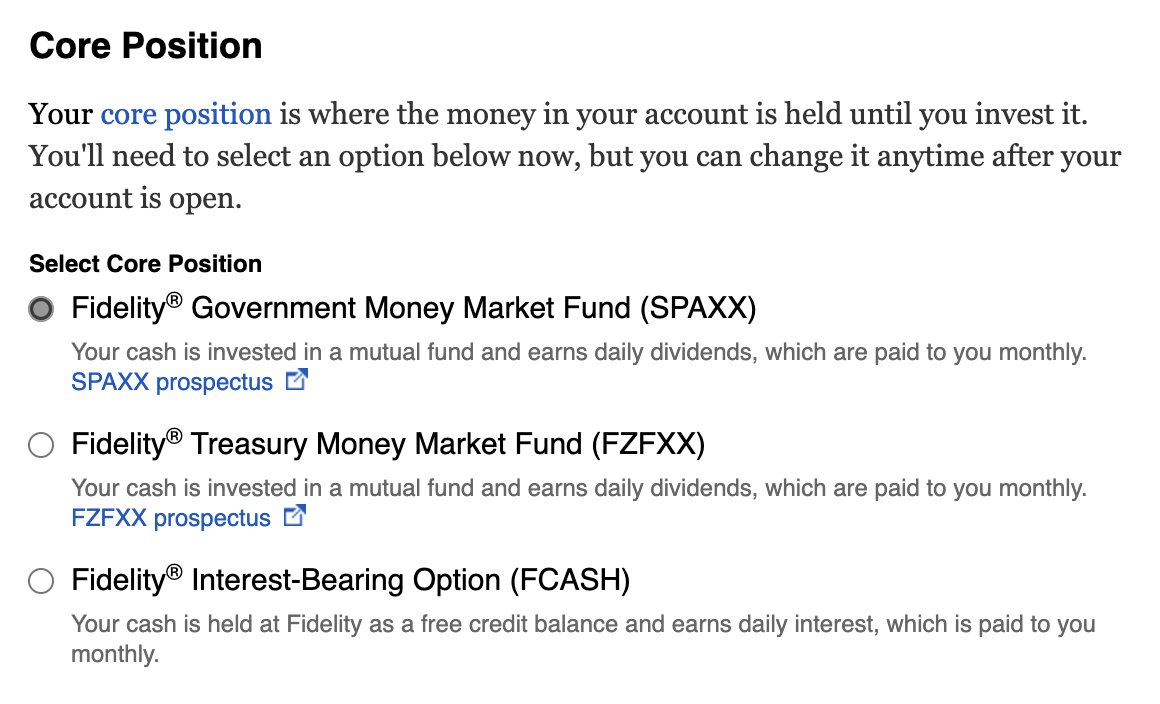

Spaxx Vs Fzfxx Vs Fcash Best Fidelity Core Position Personal Finance Club

Opening a Fidelity account automatically establishes a core position which is needed for processing cash transactions and for holding univested cash.

. This is essentially your core position. The Fidelity Cash Management Account is a brokerage account designed for everyday spending and comes with many convenient cash management features. Am I interpreting it right - when you transfer money from your checking to fidelity brokerage account it goes into core position which charges you for the time until its invested.

The options I have are SPAXX FCASH FZFXX. For example if you have 75 in an SP 500 index fund like VOO and 25 uninvested cash that 25 cash will automatically go into whatever fund or vehicle you select as your core position. A Money Market Fund like the example above with ticker SPAXX is a fund that basically invests in cash.

FZFXX Post by MikeG62 Thu Dec 26 2019 234 pm I use FAFXX as the core in my taxable account but do typically sweep any significant balance in there to FZDXX. This is one of the best Fidelity funds for you. What is a core position.

It holds cash CDs possibly. Initially they offer investment options but basically that means they put my deposit in a Money Market Fund called core position. Fidelity Money Market Fund Rates In a regular brokerage account a money market mutual fund serves as the core position.

I dont plan to let money sit in the core position but if it happens I want to know which is best. Fidelity offers two funds that can be used for this purpose. 17 hours agoFidelity Investments one of the largest financial services providers today announced the launch of Fidelitys workplace Digital Assets Account DAA the industrys first offering that will enable individuals to have a portion of their retirement savings allocated to bitcoin through the core 401k plan investment lineup.

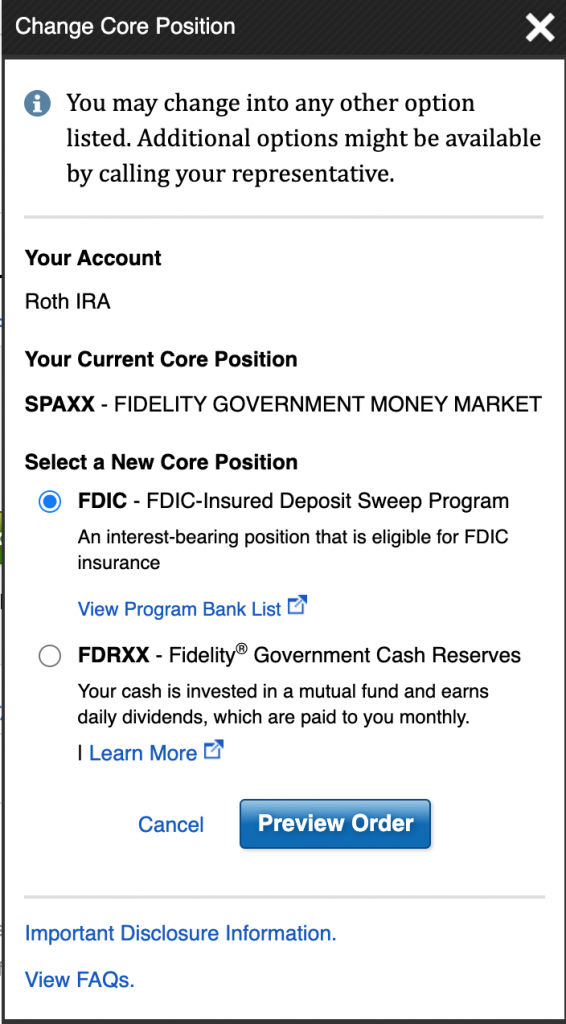

When you open a Fidelity account a core position is set up to process cash transactions and to hold uninvested cash. Enabling interested employers to offer their employees access to bitcoin through an investment option in their core 401k retirement plans on Fidelitys secure platforms is a significant milestone in advancing Fidelitys position as a holistic digital assets service provider. It is currently yielding 026.

The first is the Fidelity Government Money Market Fund SPAXX. I searched the internet and found that Vanguard does pretty much the same thing. 17 hours agoFidelity Investments Advances Leading Position as Digital Assets Provider With Launch of Industrys First-of-Its-Kind Bitcoin Offering.

It seems like SPAXX and FZFXX are the same thing. It means your cash holding account it has nothing to do with the central investments in. I recently opened an account with Fidelity to invest in stocks ETF mutual funds.

Fidelity has something they refer to as a Core Position. What is a core position and how does it work. There are more than 200 Fidelity Funds to choose from so finding.

What is a core position. Its a position in your account that acts like a wallet. Best Fidelity Funds Overview In the mutual fund world Fidelity Investments stands at or near the top in terms of assets under management number of funds offered and reputation.

Im about to open a Fidelity brokerage account but Im not really understanding the core positions. To the wrong question I think. Fidelity Investments Advances Leading Position as Digital Assets Provider With Launch of Industrys First-of-Its-Kind Bitcoin Offering for 401k Core Investment Lineup.

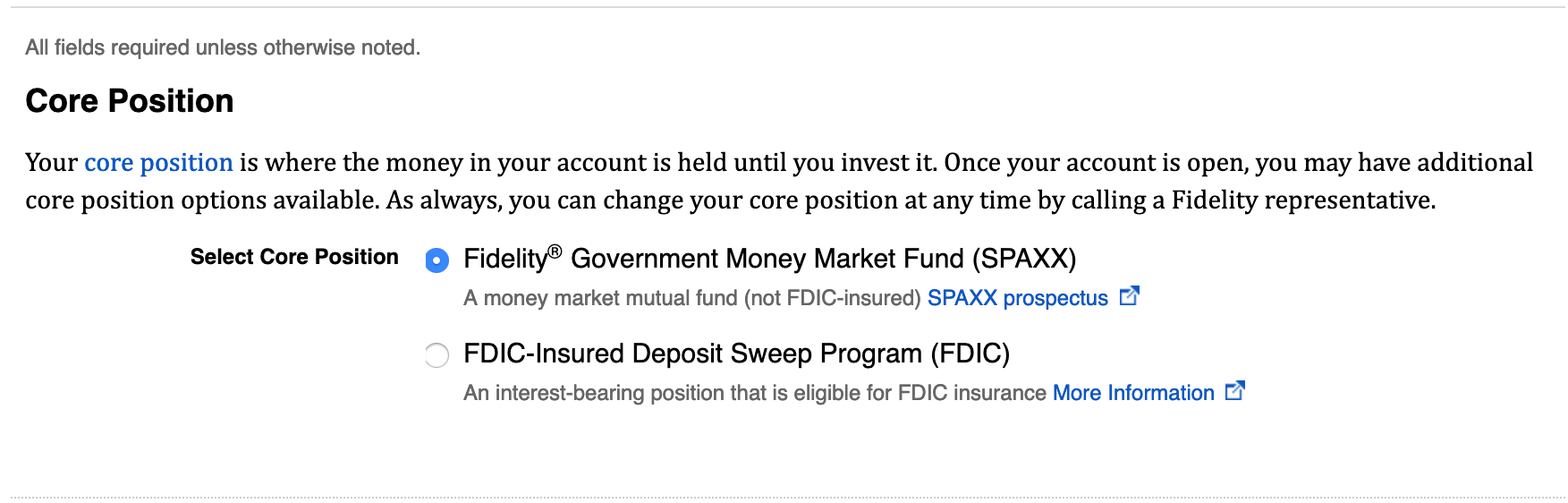

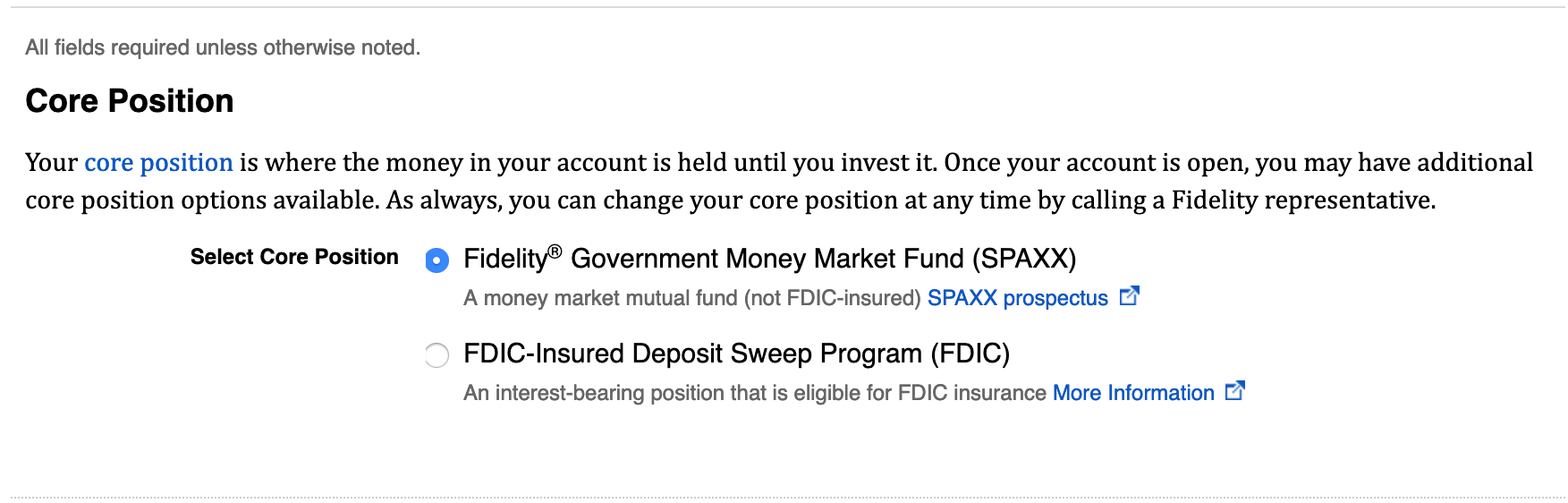

A government money market fund or treasury money market fund. By default SPAXX a money market fund will hold your uninvested cash. Your Core Position is how cash is held in your account when its not invested in something else like a target date index fund.

Fidelity provides the FCASH account so account holders can still make money off their core accounts. And when you add up the top 10 positions you get 27 or so of the funds total assets. Cash Balances that you deposit into your Fidelity Cash Management Account core position are held in an FDIC-Insured Deposit Sweep 1 and will earn a variable rate of interest as indicated in the chart below.

Your core position at Fidelity simply refers to where your uninvested cash goes inside your account. Your core position holds the cash in your account. When you open a Fidelity account you are automatically assigned a core position.

I just noticed that the core position has expense ratio. That cash just sitting there needs to be in something so Fidelity is asking how you want to hold it. The innovative new offering which.

I have some money sitting in fidelity core position SPAXX. The other is the Fidelity Treasury Fund FZFXX. Watch this video to learn how a core position works.

Account holders can also choose from two other core positions. When you are ready to invest the cash in your core position will be used to cover the. Aaron Brown gave a staggeringly complete and useful answer.

Its primary function is to process cash transactions and to hold uninvested cash. Fidelity Core Position Just joined fidelity and the cash is held in a core position which is cool because it earns decent interest. Answer 1 of 5.

Which Core Position Should You Choose Spaxx Vs Fdic Fidelity Personal Finance Club

Trading Faqs About Your Trading Account Fidelity

Spaxx Vs Fdic Vs Fdrxx Best Fidelity Core Position Personal Finance Club

Comments

Post a Comment